In a video, a man walks into a vegetable shop for lemons. He pays 5 rupees for the lemon and presents a small glass. The vendor takes out a syringe, inserts it into the lemon. He pulls out 10 ml of lemon juice using the syringe and gives it to the customer. This video is a comedy sketch, which is going viral on social media. But underneath this comedy video lies a great tragedy unfolding in India.

The skyrocketing prices of food and fuel, exacerbated by rising unemployment is wreaking havoc for millions in India. Furthermore, the significant decline in workers’ wage incomes[1] pandemic in both urban and rural India and adverse impact of COVID -19 are pushing the poor into the corner. But as the crisis looms, the Narendra Modi led BJP government is busy passing the burden onto the people.

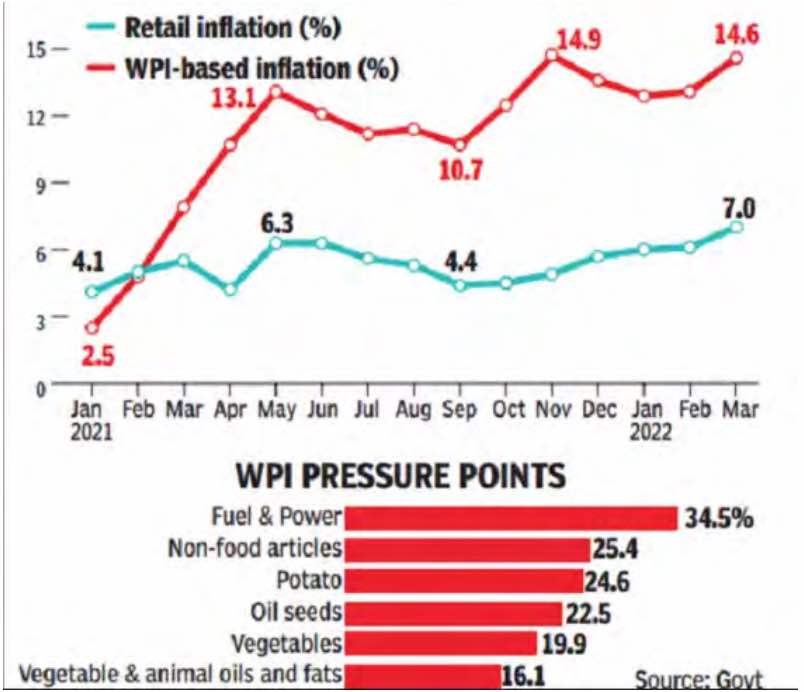

In terms of numbers, the retail inflation (at your neighbourhood shop, also known as the consumer price index or CPI) touching 7% (highest in last 18 months), it has breached the Reserve Bank of India’s tolerance range of 2 to 6%. The Wholesale Price Index (WPI) too has hit a level of 14.55% in March, 2022. This means, the Wholesale inflation averaged nearly 13% in 2021-22, more than double the rate of retail inflation. The alarming fact is that this happens to be the highest annual number in three decades.

At the Wholesale level, the following commodities are shooting up the inflation graph - fuel and power inflation at 34.4%, wheat at annual 14%, vegetables at 19.9% and potato prices soaring at 24.6%. A look at the retail inflation data clearly provides us with warning signs- food prices are skyrocketing at the consumer/shop level. Food and beverages inflation has hit 7.47% in March, with oils and fats at 18.8%. The vegetable inflation is crossing 11.6%, nearly doubling from the 6.1% rate in February)! Meat and fish prices recorded 9.63% inflation, up from 7.4% in February. Furthermore, commodities such as clothing and footwear inflation touched 9.4%, with footwear alone touching almost 11.3%.

This divergence in CPI and WPI rate means that in the coming months the consumers will be further hammered with the rising prices. The impact of drastic increase in prices of petrol, diesel and cooking gas in the mid of March (post the assembly elections in 5 states) will begin fully reflecting in retail inflation in coming weeks.

Modi made Disasters- Back to back

The above numbers and percentages of inflation are already hitting the masses hard and this crisis is not just due to the Russian invasion of Ukraine. While the war in Ukraine has disrupted the global supply chain and pushed the crude oil prices into an upward trend, the unfolding crisis is due to the cocktail of disastrous policy taken - demonetisation, Good and Services Tax (GST), divestment, privatisation and austerity - by the far-right and pro-corporate Modi government. The spillover effect of these policies has led to drastic rise in unemployment and fall in wages, which has further exacerbated the inflation.

Neoliberal Rush

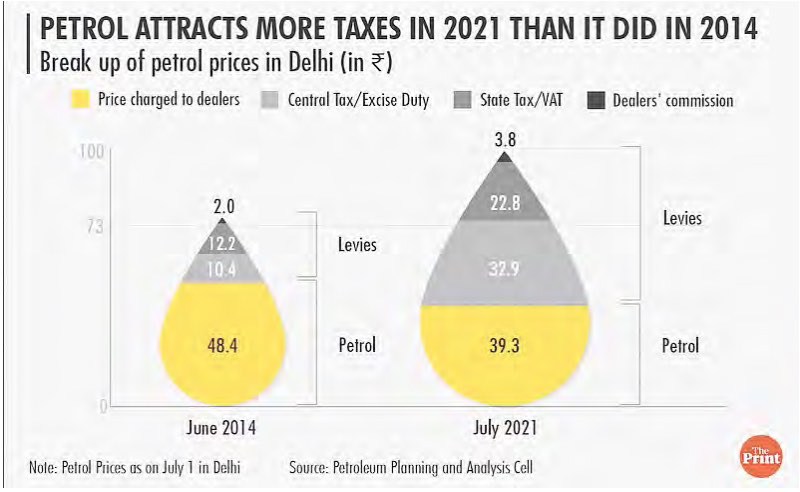

To understand the current inflation trajectory the current monetary policy of the government needs to be dissected. Since the BJP government came to power in 2014, the corporate role in policy making has been the mantra - which Modi calls as ‘Minimum Government, Maximum Governance’ or ‘Ease of doing business.’ But whatever the name may be, the crux is the corporate takeover. The corporates, like Adani and Ambani among others, have pushed for deregulation of prices of essential commodities including the cost of life-saving drugs, fuel prices etc. This means that the ‘market’ determines the cost of the commodities rather than the government controlling the prices for public good. For example, most pharmaceutical companies, on the pretext of Covid, have increased the prices of medicines by 20 per cent to 50 per cent. In case of fuel, the deregulation in 2010 and 2015 has pushed the cost of the domestic fuel prices towards an upward trend, even in the period when international crude oil prices were decreasing. This ever increasing price of petrol and diesel by oil companies has put constraints on the supply and transport chain, thus increasing the prices of essential commodities like food and vegetables. The Central Government always has the option to cut the highest-ever taxation levels on petrol diesel to cushion the people from the increase in crude oil prices. To put things in context, if the Modi Govt only withdraws the increase in excise duty hiked by it after 2014, it would result in prices of petrol and diesel coming down by Rs 20/litre directly.

With rampant privatisation and divestment of Public Sector Undertaking/ companies and tampering with the Essential Commodities Act, the government is ensuring a complete corporate takeover. As much needed commodities and services end up at the hands of the corporate and away from government control, prices are skyrocketing amid corporate profiteering and fuel price constraints on transport. Privatization intensifies price inflation in general. But, despite the suffering of people, the government is a mute spectator and ultimately, this inflation is being passed on to the people.

Loss of Livelihood

At the same time as supply chain cost increases, the country has witnessed a decrease in wages and rise in employment, with millions of Indians unable to afford commodities required for daily needs. The disastrous policies of demonetisation and GST has further shut down several small and medium scale industries, leaving people without means for sustenance.

Studies have pointed out that as high as 84 % of Indians have taken a hit on their incomes during the pandemic while unemployment remains at a high level of above 8 percent. Labour Force Participation rate fell to historic level of less than 40 percent. This means less than 40 % of people in working age are looking for jobs presently giving up on hope of finding jobs believing that no jobs exist. Thus, it’s not that people are unemployed only but in fact they have even given up the hope of finding employment which is best manifested in tendencies of reverse migration to rural areas as survival becomes the priority.

CMIE data shows that the actual labour force numbers have shrunken by 3.8 million during March 2022 to 428 million. This is the lowest labour force in eight months, i.e. since July 2021. Employment shrunk by 1.4 million to 396 million in March 2022, which was the lowest level since June 2021. Considering these employment and inflation numbers together it’s not difficult to see that it’s the ordinary Indian who are at the receiving end as economic policies during Pandemic worsens the inequality further to devastating levels.

The Credit Trap

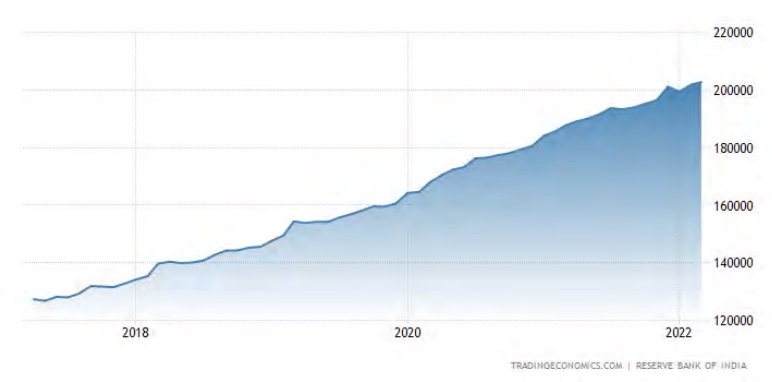

As millions of Indians face loss of livelihood and means of sustenance, the government’s solution has been to encourage more loans and credits instead of providing jobs. Central Govt and RBI has resorted to credit infusion to sustain aggregate demand. The lion share of much boasted 20 lakh Crore relief packages amidst COVID pandemic was actually in the form of extending credit in banking and financial system through different monetary policy tools and schemes to grant credit in priority sectors. It’s no secret to know that much of home loans and even Kisan Credit Cards (KCC) don’t essentially go into the areas intended as it is very difficult to track actual usage. This credit based monetary policy has led to more inflow of cash in the market than the level of commodities. The expansion of credit can be seen in boost in M3, which shows availability of money supply in the economy and is used as a measure of money supply to determine policy regarding inflation. M3 means money supply that includes cash, savings deposits, and easily-convertible near money as well as large time deposits, institutional money market funds, short-term repurchase agreements (repo), and larger liquid assets. As per RBI figures, as on March 2022, M3 was around Rs 205 lakh Crore in comparison to Rs 168 lakh Crore in March 2022. This shows 22 % percent expansion in availability of money in the economy through credit easing.

The Repo rate (rate at which the RBI lends money to commercial banks) remained unchanged for years and it was only recently that the marginal cost of funds-based lending rates (MCLR) for the first time in three years. These soft loan policies (with low repo rate and MCLR, people were given loans at low interest rate) meant that more people were encouraged to take loans. Further as prices of commodities increased and wages decreased/ lost, people were forced to seek loans from banks or micro finance for their survival. For example, the RBI recently has increased eligibility criteria for microfinance loans to those having an annual income of up to Rs 3 lakh, while removing the interest rate cap on such loans. The objective of this move was to encourage more people to access the easy-to-get-but-cut-throat microfinance loans. This push is visible in the ground as data shows that microfinance loan portfolio of all lenders grew about 10% year-on-year to Rs 2.56 lakh crore at the end of December, 2021, compared with Rs 2.33 lakh crore a year back[2].

Further, as the government pushes for cash transfer schemes instead of a strong Public Distribution System, there is increasing money revolving in the system. For example, the cash transfer scheme for farmers is being introduced by the government but at the same time reducein subsidy for fertilisers is adversely impacting agricultural production. In this year’s Union Budget, the government has cut subsidy Urea 17% and allocation for NPK subsidy reduced by 35%. In such a scenario, the cash transfer scheme is proving counter-productive as farmers are unable to procure fertilisers. This reduction in subsidy, combined with the shortage of fertiliser stocks[3] is pushing the cost of agricultural production, and thus the cost of food and vegetable commodities.

With this money chasing the same level of commodity and services, the inflation is bound to increase with easy availability of money for speculative purposes too. In absence of actual expansion in Gross Fixed Capital formation in light of this credit infusion it can be concluded that much of it has gone to speculative purposes pushing commodity prices up. As per the latest figures available on the count, Investments as shown by the Gross Fixed Capital Formation or GFCF for Q3 of FY22 stood at Rs 11,50,761 Cr from Rs 11,28,117 Cr in the same period last year showing a growth of mere 2 per cent despite low base effect.

Speculation,

Black Marketing and Profiteering

As government remains a mute spectator to the tragedy unfolding due to corporate greed, the blackmarketing and profiteering are rampant.

The government policy approach of infusing liquidity to tackle declining growth increased inflation systematically by allowing speculative trading in commodities for profiteering and windfall gains by financial capital through future commodity trading in Multiple Commodity Exchange (MCX) and National Commodity & Derivatives Exchange Limited (NCDEX). The tendency of hoarding and black marketing of essential commodities at this time pushes it even further. The government wanted to legalise this practice as part of farm bills by diluting the Essential Commodities Act. The farmers movement didn’t allow that to happen, but it’s no secret that the actual implementation of the act on ground is almost negligible with government more than willing to look the other way while hoarding and black marketing goes unabated.

Speculative trading on MCX and NCDEX was leading to price hike on essential commodities but the government has been neglecting it. It was only in Dec, 2021 when govt was pushed in a way to concede this when it banned trading in seven food items such as palm oil, soybean oil, sunflower, wheat, rice etc under pressure of public opinion and as a measure to show that it is serious about inflation but the step was too late and too little. The Central government has also been claiming that it is using measures like stock limiting, buffer stock and price stabilisation fund to regulate prices of food items. It’s there for everyone to see that nothing seems to be materialising as brought out by inflation numbers themselves despite tall claims in absence of lack of actual capacity to intervene in material way due to structural constraints brought about by successive doses of deregulation and liberalisation.

An RBI study points out this trend when it brings out the finding that for 16 major food items covered in the study such as Onion, Tomato, groundnut, Banana, Wheat, Tur etc farmers on an average gets only 28 % to 78 % percent out of retail prices of different commodities. Moreover, the profiteering tendencies also gets on roll with corporates hiking prices more than what is justifiable through increase in their input costs. This is most evident in drug prices where the pharmaceutical lobby has been able to pressurise the government in conceding to their demands of 10 % hike in prices of scheduled drugs and 20 % hike in prices of non-scheduled drugs justifying it in name of increase in input costs.

Conclusion

Oxfam, in a report, warns that over 260 million people globally could be pushed into extreme poverty by the end of the year due to the pandemic and rising energy and food costs. Oxfam International said, quote, “Without immediate radical action, we could be witnessing the most profound collapse of humanity into extreme poverty and suffering in memory.”

India will have a large share of this 260 million people who are staring at extreme poverty as the prices skyrocket. India’s bandwagoning with policies of the International Monetary Fund (IMF) of austerity and cutting down of government spending on the social sector has led to a disastrous situation.

Without any means of sustenance and lack of public food security net, hunger and malnutrition will rise. According to Global Nutrition Report 2021, as many as 53 % of women of age group 15-49 years were anaemic[4]. Another worrying figure is that 34.7 % of children under 5 years of age are stunted and 17.3 % of children under 5 are suffering by wasting, another life-long impact of prolonged malnutrition. Around 60 % of child mortality under the age 5 is directly linked to poor nutrition.

The unfolding tragedy of inflation has an eerie similarity with COVID 19 pandemic in India. The pandemic has shown us how absolute lack of public sector intervention in health has led to death and destruction. As the pandemic waves hit India, the corporate medical sector attacked itself to the crisis like a parasite for its profiteering. The prices of essential and life-saving drugs (in the range of 25-180 %) and medical equipment/ services skyrocketed despite availability of stocks as the corporate sector looked for profit. In the end, the poor and toiling masses suffered and died.

Inflation can only be curtailed if the government is willing to move out of market fundamentalist mindset which is resulting in gross economic inequalities, supply side constraints, limiting production of essential commodities including stagnation in agriculture. It would require expansion of public procurement and distribution network and public sector alternatives across sectors to keep a check on corporate profiteering and speculation by financial capital, stockists and traders to determine prices in the market in their favour. This will require redesigning whole approach towards economic policy making. But with the government announcing openly its desire to privatise everything barring one or two public sector enterprises in a declared ‘strategic sector’, it’s clear that the government’s ability to intervene would only subside further.

This naturally will lead to corporate interests determining prices in market rather than objectives of public welfare and ensuring availability of commodities of mass consumption to people at reasonable prices. It is left only to unified assertion of people movement to pressurise govt to reverse this trend in economic policy making and demand regulation of prices, PDS and objective of people’s welfare as governing mechanism to determine prices in economy.

[1] https://www.livemint.com/news/india/wages-in-india-fell-3-6-23-following-pandemic-ilo-11606985526476.html

[2] https://economictimes.indiatimes.com/industry/banking/finance/microfinance-loan-rises-10-to-rs-2-56-lakh-crore-mfin-data/articleshow/90519562.cms

[3] As per the analysis of the Integrated Fertilizer Management System (iFMS) data from the Department of Fertilizer, Government of India for October 2021 shows a severe lack of fertiliser products.

[4] https://www.google.com/url?q=https://mediaindia.eu/society/nutrition-malware-hits-women-children-in-india-nfhs5/&sa=D&source=docs&ust=1650617563010777&usg=AOvVaw1mD5mYf2YQZ106viKf-jhI